We are pleased to present the June 2022 edition of Accru Financial Reporting Update, in this edition we will provide a general update on recent activity in the financial reporting space.

A number of articles are relevant for certain entities only and therefore this edition has been structured as follows:

- Relevant to all entities

- Relevant to all NFP entities

- Relevant to NFP entities registered with the ACNC

- Contacts

a. Relevant to all entities

Standards effective for the first time for June 2022 reporters

The new standards effective for the first time at 30 June 2022 predominantly relates to the changes to the Australian Reporting Framework to reduce the number of for-profit entities who are able to prepare special purpose financial statements and the introduction of the new Tier 2 reporting framework.

Sustainability exposure drafts

In November 2021, the IFRS Foundation established the International Sustainability Standards Board (ISSB) with the aim to deliver a comprehensive global baseline of sustainability-related disclosure standards.

In March 2022, the ISSB have released their first two exposure drafts which have also been issued for comment in Australia by the AASB as ED321 Request for Comment on [Draft] IFRS S1 General Requirements for Disclosure of Sustainability-related Financial Information and [Draft] IFRs S2 Climate-related Disclosures which is open for comment until 15 July 2022.

The two exposure drafts are:

- S1 General Requirements for Disclosure of Sustainability-related Financial Information

- Disclose information that is material and gives insights into an entity’s sustainability-related risks and opportunities that affect enterprise value.

- S2 Climate-related Disclosures

- Disclosure of Scope 1,2 and 3 Greenhouse Gas emissions

- Specific disclosures based on industry and sector.

These are expected to be issued as standards by the end of 2022 and our end of year newsletter will include more information on these if this is the case, in the meantime, we encourage all entities to review the requirements and provide comments to the AASB and / or have internal discussions regarding the impacts of these standards.

ASIC activity

Amendments to financial statements

Although your entity may not be regulated by ASIC, it is important to review the errors which they are finding on their review of listed (and other) financial statements to ensure your directors are aware of current financial reporting focus areas and their relevant to your entity’s financial statements.

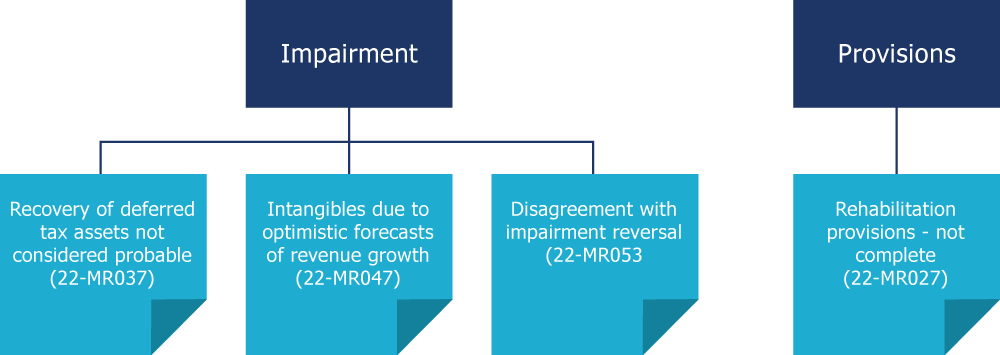

There have been four mis-statements covering two topics identified by ASIC during their financial statement reviews over the previous few months, the media release number has been identified for further reference.

Non-lodgement of financial statements

ASIC are continuing to impose penalties on entities who fail to lodge their financial statements or hold Annual General Meetings (AGM), we urge all our clients to ensure that they understand their obligations under the Corporations Act 2001 to ensure there is no inadvertent breaches.

Financial reporting by AFSL holders ASIC are expected to release their policy around preparation of general purpose financial statements by Australian Financial Service Licence (AFSL) holders prior to June 2022 which will specify which AFSL holders have to prepare Tier 1 financial statements rather than Tier 2 general purpose financial statements. This definition is likely to be based on the definition of public accountability included in AASB 1053 Application of Tiers of Australian Accounting Standards along with additional ASIC criteria including the holding of client money.

b. Relevant to all NFP entities

Narrow scope project on revenue

As an update to the article in the November 2021 newsletter, the AASB has finalised the outputs from the narrow scope project on NFP revenue and these are detailed below for your reference:

- Staff FAQ added on the scope of AASB 15 and AASB 1058 – AASB Staff FAQs for Not-for-Profit Entities (updated)

- Additional example added to AASB 15 in relation to the principles used to assess revenue recognition of upfront fees (AASB 2022-3)

- AASB staff webinar providing information regarding some of the common issues raised and guidance in the accounting standards and supporting material (available on the AASB YouTube channel)

- Key facts document providing an overview of the interaction between and requirements of AASB 15 and AASB 1058 (Key facts: Accounting for Income of Not-for-Profit Entities)

In addition, AASB 2022-3 includes an amendment to the Basis of Conclusions which makes the option for NFP entities to measure the right-of-use asset arising from concessionary leases at cost or fair value a permanent option for NFP private sector entities.

c. Relevant to NFP entities registered with the Australian Charities and NFP Commission (ACNC)

Disclosure of Key Management Personnel (KMP) remuneration

Further to the increased revenue thresholds announced by the ACNC for years ending 30 June 2022, which was discussed in our December 2021 newsletter, the ACNC have confirmed that they require large charities preparing special purpose financial statements to include key management personnel (KMP) remuneration in the notes to the financial statements from 30 June 2022.

The KMP disclosures in the financial statements will vary depending on the type of financial statements prepared and the options chosen. Note: comparatives are not required in the 30 June 2022 financial statements.

Further to the discussion in the November 2021 newsletter, we have illustrated these requirements through the inclusion of two scenarios

Scenario 1:

A large ACNC registered charity has determined that their KMP comprise the Board of Directors (volunteer) and the General Manager whose remuneration comprises Salary $100k and superannuation guarantee payments of $10k.

| Type of financial statements | Disclosure |

| General purpose – Tier 2[1] (no changes) | The KMP remuneration included within employee expenses is $110k. |

| Special purpose: AASB 1060 or AASB 124 (using ACNC Commissioner exemption not to disaggregate remuneration into categories) requirements | No disclosure since only one remunerated KMP. Best practice recommendation – disclose this fact. |

| Special purpose: AASB 124 requirements | No disclosure since only one remunerated KMP. Best practice recommendation – disclose this fact |

Scenario 2:

A large ACNC registered charity has determined that their KMP comprise the Board of Directors (volunteer), the General Manager whose remuneration comprises Salary $100k and superannuation guarantee payments of $10k and the Financial Controller whose remuneration comprises salary $80k and superannuation guarantee payments of $8k.

| Type of financial statements | Disclosure |

| General purpose – Tier 21 (no changes) | The KMP remuneration included within employee expenses is $198k. |

| Special purpose: AASB 1060 or AASB 124 (using ACNC Commissioner exemption not to disaggregate remuneration into categories) | The KMP remuneration included within employee expenses is $198k. |

| Special purpose: AASB 124 requirements | The KMP remuneration included within employee expenses is: $ Short-term employee benefits 180,000 Post-employment benefits 18,000 198,000 |

d. Contacts

If you are affected or have questions on any of the areas covered in this newsletter, please reach out to us.

"

"