We are passionate about helping financial advisers with their succession planning, at any stage.

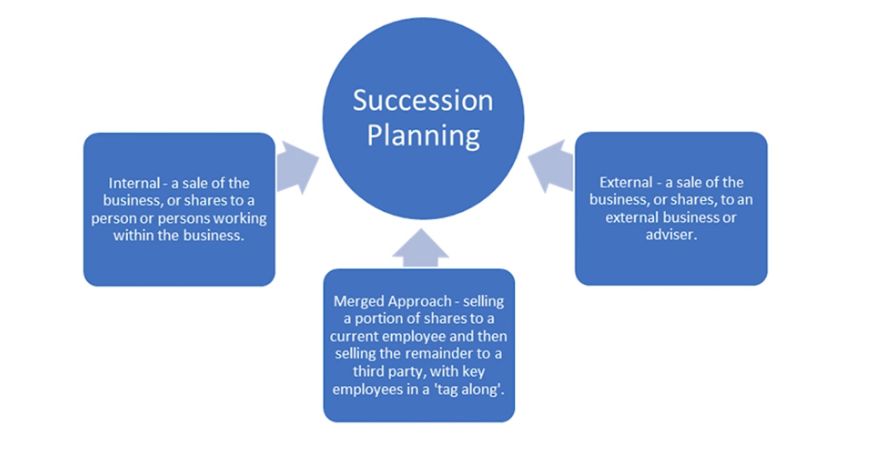

The approaches that can be used for planning your succession include:

You may already know your option, or know what you will need to do, however broadly speaking you can use external and internal succession planning in the following circumstances.

| External | Internal |

| No internal successors | Willing and able successors |

| Want to exit now, not in 3-5 years | Profitability to pay for the investment, e.g. decent payback period |

| Too large, too high a sale price | Management systems in place |

| Not profitable with current operations | Time to execute |

Please contact our office to have a discussion around how we can help you frame your succession plan.